Cyprus Property Taxation

Cyprus Property Tax Guide 2025: Comprehensive Insights by Blue Sky Properties

Navigating the intricacies of property taxation in Cyprus is crucial for both local and international investors. At Blue Sky Properties, we aim to provide a detailed overview of the current tax landscape, ensuring you're well-informed and prepared for your real estate ventures in 2025.

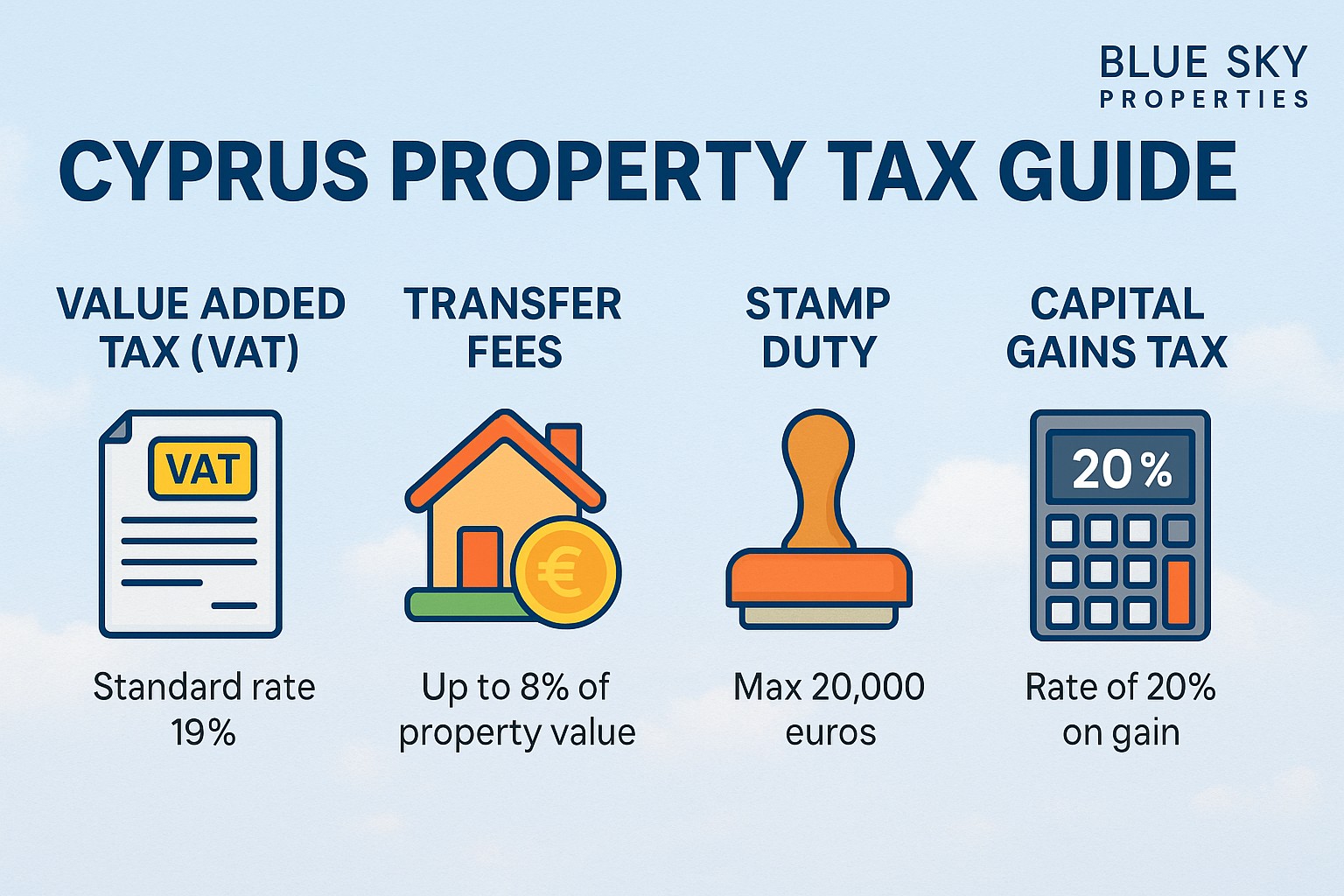

1. Value Added Tax (VAT) on Property Purchases

Understanding VAT implications is essential when purchasing property in Cyprus.

Standard VAT Rate

- 19% applies to the purchase of new properties.

Reduced VAT Rate

- 5% is available for first-time buyers under specific conditions:

- The property will serve as the buyer's primary residence.

- The total covered area does not exceed 200 square meters.

- The value of the property does not exceed €350,000.

It's important to note that if the property is sold or rented within 10 years, a portion of the VAT benefit may need to be repaid.

2. Transfer Fees

Transfer fees are payable to the Department of Lands and Surveys upon the transfer of property ownership.

Fee Structure

- 3% on the first €85,000 of the property's market value.

- 5% on the next €85,000.

- 8% on any amount exceeding €170,000.

- For properties subject to VAT, transfer fees are exempt.

3. Stamp Duty

Stamp duty is levied on the purchase agreement and is calculated as follows:

- 0.15% on the first €170,000.

- 0.20% on any amount exceeding €170,000.

The maximum stamp duty payable is capped at €20,000.

4. Capital Gains Tax (CGT)

CGT is imposed on the profit from the sale of immovable property in Cyprus.

Key Points

- 20% tax rate on the gain.

- Exemptions include:

- €17,086 for individuals selling their primary residence.

- €85,430 for individuals selling agricultural land.

- €25,629 for other disposals.

Deductions are available for expenses such as improvements and inflation indexation.

5. Annual Property Taxes

As of 2017, the Immovable Property Tax has been abolished. However, property owners are still subject to:

- Municipal Taxes: Approximately 0.1% to 0.2% of the property's market value.

- Sewerage Board Fees: Approximately 0.3% to 0.35% of the property's market value.

These rates may vary depending on the municipality.

6. Rental Income Taxation

Income derived from renting property in Cyprus is taxable.

For Individuals

- 0% for annual income up to €19,500.

- 20% for income between €19,501 and €28,000.

- 25% for income between €28,001 and €36,300.

- 30% for income between €36,301 and €60,000.

- 35% for income exceeding €60,000.

Special Defence Contribution (SDC)

- 3% on 75% of the gross rental income.

- Non-domiciled residents are exempt from SDC.

For Companies

- 12.5% corporate tax on net rental income.

7. Property Taxation for Developers and Investors

Developers and investors should be aware of specific tax considerations:

- VAT: Applicable on the sale of new properties.

- Transfer Fees: Exempt if VAT has been paid.

- Capital Gains Tax: Applicable on the sale of properties.

- Corporate Tax: 12.5% on net profits.

- Proper structuring and planning can optimize tax liabilities.

8. Tax Benefits for Non-Residents

Non-residents investing in Cyprus real estate can benefit from:

- Equal Tax Treatment: Same tax rates as residents.

- No Inheritance Tax: Cyprus does not impose inheritance tax.

- Double Taxation Treaties: Cyprus has agreements with numerous countries to avoid double taxation.

These benefits make Cyprus an attractive destination for international investors.

Frequently Asked Questions (FAQ)

Q1: Can non-residents buy property in Cyprus?

Yes, non-residents can purchase property in Cyprus. However, they must obtain permission from the Council of Ministers, which is typically granted.

Q2: Are there any annual property taxes in Cyprus?

While the Immovable Property Tax was abolished in 2017, property owners are still subject to municipal taxes and sewerage fees, which vary by location.

Q3: How is rental income taxed in Cyprus?

Rental income is subject to personal income tax based on progressive rates. Additionally, a Special Defence Contribution of 3% on 75% of the gross rental income applies, unless the owner is a non-domiciled

Q4: What is the VAT rate on property purchases?

The standard VAT rate is 19%. However, a reduced rate of 5% is available for first-time buyers purchasing a primary residence, subject to specific conditions.

Q5: Are there any exemptions on Capital Gains Tax?

Yes, exemptions include €17,086 for individuals selling their primary residence, €85,430 for individuals selling agricultural land, and €25,629 for other disposals.